OUR SERVICES

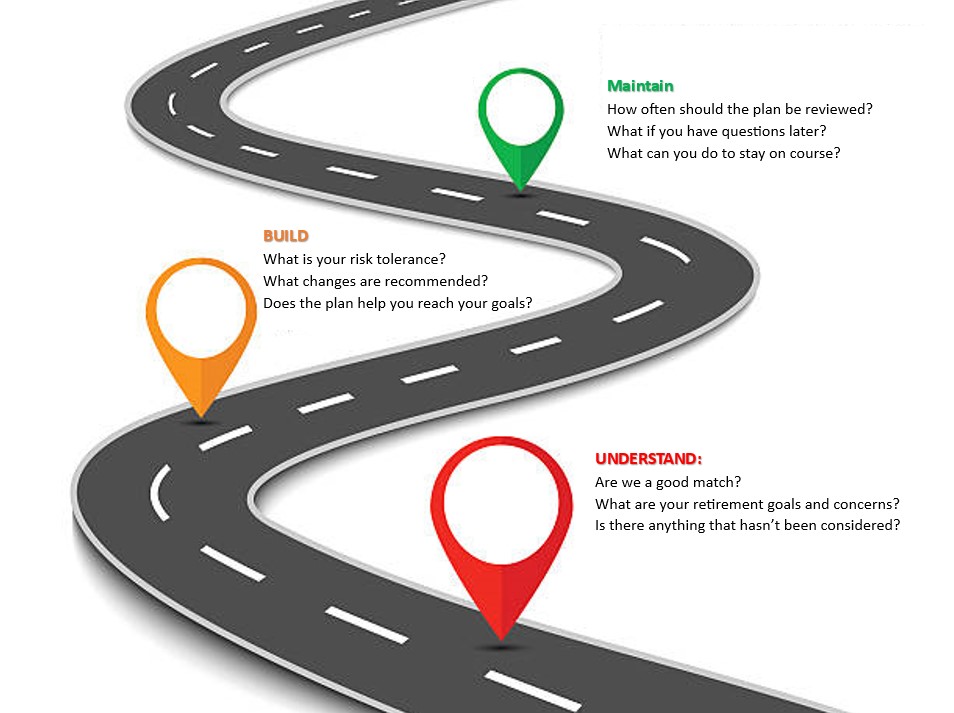

FINANCIAL PLANNING

At Integrity Financial Group, we offer our prospective clients a complimentary assessment of their current investments, personalized income projections, and recommend ideas for immediate implementation.

RETIREMENT PLANNING

We have found that many financial services professionals focus on products; our experience shows that our clients’ needs are best met by focusing on processes and, most importantly, the people. Our coordinated approach ensures that your plan is developed using an all-inclusive view. We integrate all aspects of your financial picture in a coordinated effort to provide for financial clarity and multi-generational wealth.

This includes:

- Risk Assessment

- Income Planning

- Financial Needs Analysis

- Insurance Planning

- Estate Preservation

- Beneficiary Review

INSURANCE SOLUTIONS

Insurance often protects many of the most valuable assets you have: our homes, cars, your health and your loved ones. However, many American’s are unaware of the impact proper insurance planning can have on your retirement. Our firm offers several products and financial planning strategies to help you plan your retirement.

One area we focus on with our clients is keeping their nest egg as safe as possible, while still participating in market growth. Many retirees underestimate the impact a big market loss may have on the future of their income.

With the right plan, you can earn money with your money—through the use of fixed annuities and life insurance. You can create steady dependable monthly income now, in the future, or whenever you need it most.

At Integrity Financial Group, LLC, we offer:

- Fixed Annuities

- Life Insurance

- Long Term Care

- Health Insurance

- Medicare Supplements

As an independent insurance firm, we are able to shop dozens of insurance carriers to find the best rates and product solutions to fit your specific needs. We also offer complimentary reviews on your existing fixed annuity and life insurance contracts.

TAX PLANNING

Perhaps the most impactful piece of retirement planning is determining your current and future tax liability and developing strategies to minimize the amount of taxes you pay in retirement. Tax planning can have a large impact on the amount of wealth you will be able to transfer to your legacy. We will help ensure that your retirement plan is tailored to utilize both tax advantaged and taxable products to help certify you and your heirs are maximizing wealth for generations to come.

Working in concert with your personal tax professional or our partnership with local CPA firms, we can provide tax reduction strategies. Proactive tax planning allows our clients the opportunity to minimize tax burdens and build a solid foundation of tax reduction strategies that can result in years of tax savings.

Tax Planning Services

- Roth Conversion Analysis

- Year-end tax filing services

- 1040 tax optimization reports

- Personalized tax reduction reports

We strive to implement a sound, well-thought-out financial strategy to minimize year-to-year tax liabilities and provide the opportunity to maintain your current standard of living throughout retirement.

SOCIAL SECURITY MAXIMIZATION

6 important questions you should know.

Social Security provides the income stability that many retirees are looking for in retirement. Because of the complexity, there are many important individual decisions that need to be made to choose the best option for you. We have put together an informative brochure that helps you answer the following questions:

- What is your Social Security amount?

- When is the best time to start taking your Social Security Benefit?

- Are there different options if you are married?

- Is there an impact of earning additional income when you are receiving your benefit?

- How much tax are you paying on your Social Security?

- Are you concerned about the amount of retirement income you will be receiving?

ESTATE PLANNING

An Act of Love

Creating an effective strategy for your estate involves much more than eliminating estate taxes or maximizing how much you leave behind. It is primarily about two things: love and financial wisdom. It is a loving act because it allows you to protect yourself while you are alive as well as your heirs after you are gone. It is an act of financial wisdom because it enables you to protect the assets you have accumulated while also making sure that you give what you want, when you want, to whom you want, how you want. Wise planning can ensure that your financial and personal needs are taken care for the rest of your life.

This should explain why we say that estate planning is not only for the wealthy. Besides the reasons we’ve stated, everyone needs to have trusted individuals in place in the event of incapacity or death. The most important nominations are Guardians for minor children, Medical Advocates for health care decisions, as well as legal representatives to make financial decisions on your behalf if you can no longer do so. These nominations have to be made in Wills, Health Care, and Durable Powers of Attorney. In order to minimize great confusion and stress on your children Advance Directives are also necessary in order to clarify your desires with regards to end of life issues.

A Living Trust

One of the most important elements of legacy planning is the establishment of a Living Trust. Regardless of the size of your estate, it is our belief that a Living Trust is the best way to protect your financial interests and those of your family when you are no longer here to do so. The Living Trust is the most effective vehicle to minimize estate taxes and efficiently pass your assets on to your heirs. The main benefit of a Living Trust is that it bypasses both the delay, exposure and substantial expense of Probate. It also allows you to maintain control of your assets even if you become incapacitated, and can significantly protect your spouse or heirs when you are gone. A well-drafted Living Trust can provide surviving spouses and children virtually an iron-clad shield from what we call creditors and predators.

Over the past five years there have been substantial changes in the laws affecting your estate and the requirements for your representatives in the event of incapacity. Since so much has changed, we recommend that any existing plan or estate planning documents be reviewed by an attorney specializing in this unique area of law. Reviewing your legacy plan is a crucial step in providing the peace of mind of knowing that it will actually accomplish your goals and will help eliminate stress and confusion among your loved ones after you are gone. Regular reviews are important to ensure that your plan expresses your current desires and takes into consideration changes in the law as well as changes in your family’s life. It is for this reason that we consider legacy planning as one of the most loving things you can do for your loved ones.